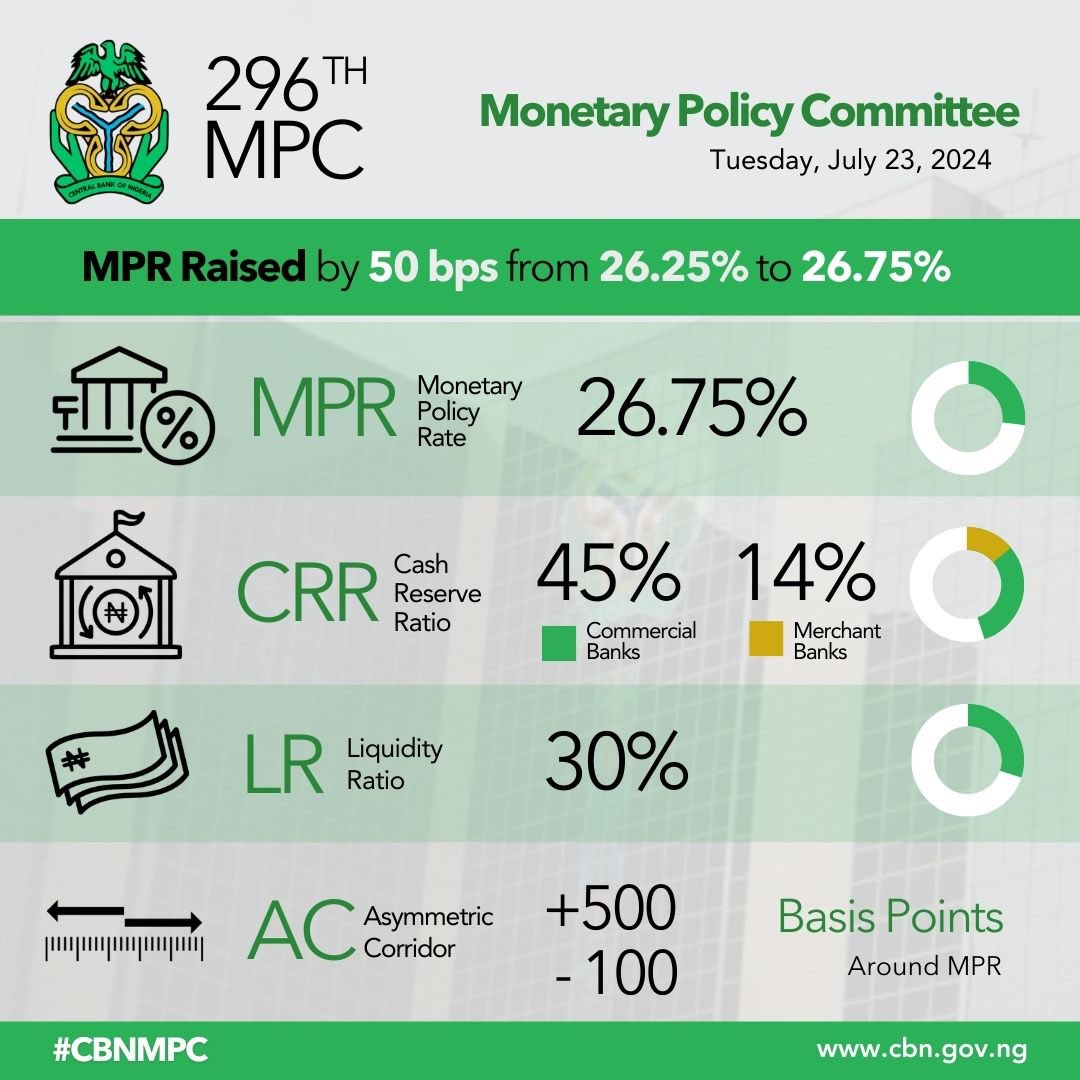

#CBNMPC Adjusts the asymmetric corridor around the MPR to +500/-100 from +100/-300 basis points. Retains the Cash Reserve Ratio of Deposit Money Banks at 45.00 percent and Merchant Banks at 14 percent. Retains the Liquidity Ratio at 30.00 percent.

CBN Governor Olayemi Cardoso emphasizes the importance of institutional strength, reiterating that the Bank remains focused on ensuring policies that positively impact Nigerians' everyday lives. The CBN’s Monetary Policy Committee expresses its resolve to get inflation under control and expresses optimism that prices will moderate in the near term. We are seeing positive outcomes from our recent efforts, including the exchange rate convergence and increased net inflows and capital importation compared to last year.

CBN MPC seeks to sustain collaboration with fiscal authorities to check inflationary pressure; also wants the Federal Government to check the activities of middlemen who hoard and move farm produce across the border to neighboring countries. We will ensure stringent implementation of policies, maintaining vigilance and ensuring compliance among all stakeholders, which is crucial for stability. In the short term, some policies may seem stringent, but they are essential for long-term sustainability and development.Governor Cardoso says CBN policy on Unclaimed Balances Trust Fund Pool Account (UBTF) aims to protect funds in dormant accounts. “We have provided a two-year compliance period for recapitalization directives, giving banks ample time to adjust and absorb economic shocks, ensuring a smooth transition”.

"Collaboration between fiscal and monetary policies will strengthen our economic foundation and drive sustainable growth, with the CBN remaining vigilant in its responsibilities,"

Central Bank of Nigeria - Governor Cardoso.

Central Bank of Nigeria