THE UNITED REPUBLIC OF TANZANIA BANK OF TANZANIA

MONETARY POLICY COMMITTEE STATEMENT

3rd October 2024

3rd October 2024

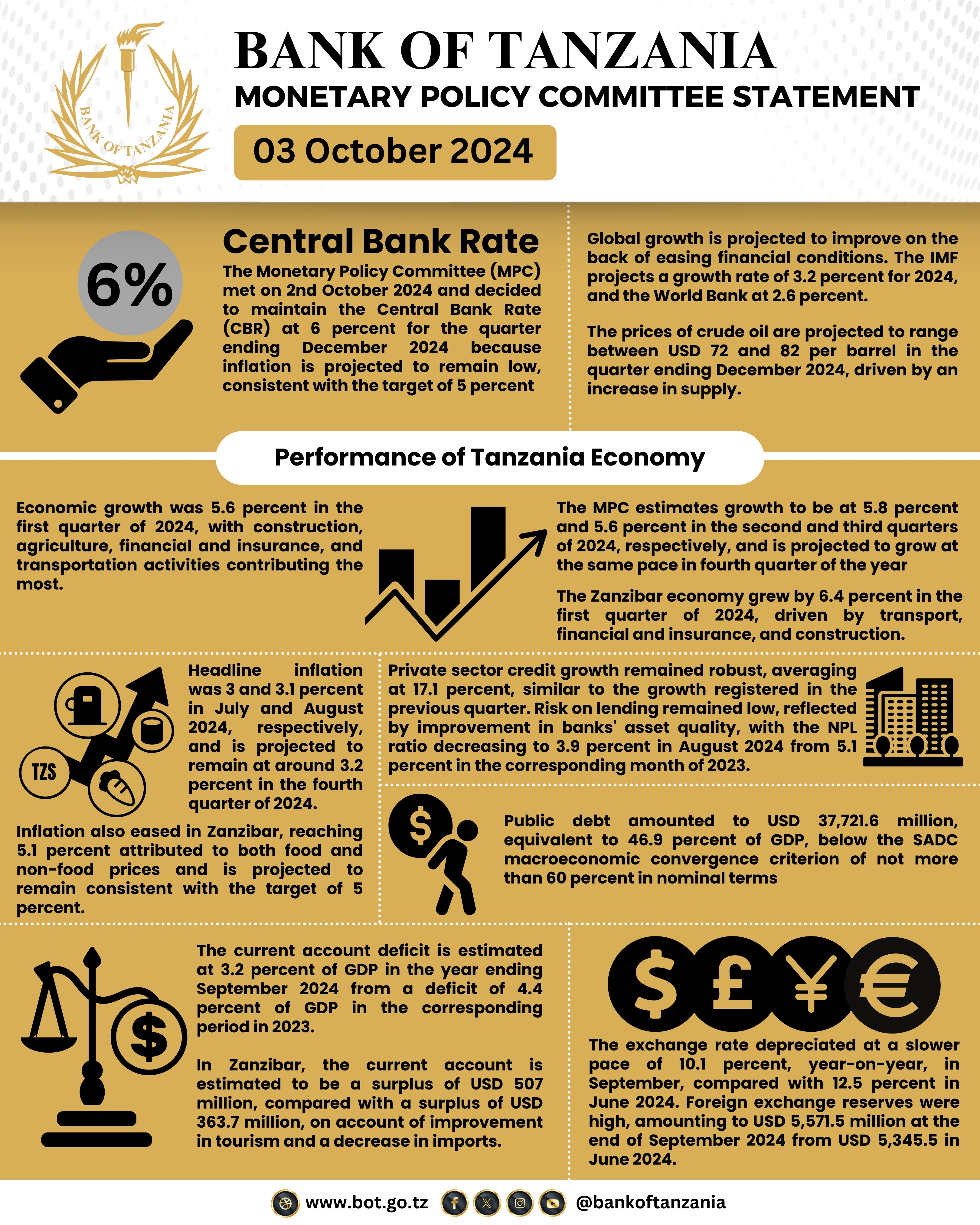

The Monetary Policy Committee (MPC) met on 2nd October 2024 and decided to maintain the Central Bank Rate (CBR) at 6 percent for the quarter ending December 2024. The decision was reached on the consideration that inflation is projected to remain low, consistent with the target of 5 percent. The MPC also projects growth to be steady in line with the improving domestic and global conditions.

Global growth is projected to improve on the back of easing financial conditions. The IMF projects a growth rate of 3.2 percent for 2024, and the World Bank at 2.6 percent. This is expected to provide impetus to domestic economic activities. Inflation is projected to continue declining, owing to the lagged impact of tight monetary policy and a decline in commodity prices, particularly crude oil and fertilizer. Most central banks are expected to either cut or maintain policy rates. Central banks in the SADC and EAC economic blocs have recently followed this policy trend. Commodity prices in the world market have been generally stable and are projected to remain at the same levels. The prices of crude oil are projected to range between USD 72 and 82 per barrel in the quarter ending December 2024, driven by an increase in supply. This is expected to reduce pressure on inflation and demand for foreign exchange in the country, as petroleum products account for about 20 percent of the import bill.

The MPC also assessed the conduct of the monetary policy in the quarter ending September 2024, as well as the recent economic performance and its outlook. The conduct of monetary policy has successfully anchored inflation expectations well within the target of 5 percent.

i. Economic growth was 5.6 percent in the first quarter of 2024, with construction, agriculture, financial and insurance, and transportation activities contributing the most. Based on high frequency indicators, the MPC estimates growth to be at 5.8 percent and 5.6 percent in the second and third quarters of 2024, respectively, and is projected to grow at the same pace in fourth quarter of the year. The projected growth is bolstered by improvements in global and domestic economic conditions. The improvement in domestic conditions is attributable to improving business environment and reforms, some of which implemented through the support of the development partners. Agriculture is expected to increase significantly due to the usage of inputs (fertilizers and quality seeds) and pesticides, as well as investment in irrigation schemes. Construction and transportation are also expected to add to the growth momentum. The Zanzibar economy grew by 6.4 percent driven by transport, financial and insurance, and construction.

ii. Inflation remained stable and within the country and regional convergence targets. Headline inflation was 3 and 3.1 percent in July and August 2024, respectively, and is projected to remain at around 3.2 percent in the fourth quarter of 2024. The stability of consumer goods prices in the world market, adequate food supply, stable power supply, and prudent monetary and fiscal policies are expected to contain inflationary pressures. Inflation also eased in Zanzibar, reaching 5.1 percent attributed to both food and non-food prices and is projected to remain consistent with the target of 5 percent. The upside risks to the inflation outlook include the potential disruption of supply chains due to geopolitical conflicts.

iii. Money supply growth slowed slightly in July to September 2024 relative to the preceding quarter. Private sector credit growth remained robust, averaging at 17.1 percent, similar to the growth registered in the previous quarter. Risk on lending remained low, reflected by improvement in banks' asset quality, with the NPL ratio decreasing to 3.9 percent in August 2024 from 5.1 percent in the corresponding month of 2023. Private sector credit growth is expected to remain high as global and domestic economic conditions continue to improve, coupled with supportive policies intended to boost economic growth.

iv. Fiscal performance was satisfactory, with tax revenue surpassing the target, largely attributable to improved tax administration and compliance. Expenditure was aligned with the available resources. Public debt amounted to USD 37,721.6 million, equivalent to 46.9 percent of GDP, within the SADC macroeconomic convergence criterion of not more than 60 percent in nominal terms. In net present value (NPV) terms, the debt was 36.4 percent for 2023/24, lower than the ceiling of 50 percent set forth in the EAC convergence benchmarks.

v. The external sector sustained improvement as the global economy normalizes from the economic shocks. The current account deficit is estimated at 3.2 percent of GDP in the year ending September 2024 from a deficit of 4.4 percent of GDP in the corresponding period in 2023. The improvement was driven by increased exports, particularly tourism, gold, tobacco and cashew nuts. The deficit is expected to further narrow, leading to subdued pressures on the foreign exchange. In Zanzibar, the current account is estimated to be a surplus of USD 507 million, compared with a surplus of USD 363.7 million, on account of improvement in tourism and a decrease in imports.

vi. Foreign exchange inflows improved on account of a seasonal increase in tourism and exports of food and cash crops. The high price of gold in the world market also contributed to the foreign exchange inflows. The exchange rate depreciated at a slower pace of 10.1 percent, year-on-year, in September, compared with 12.5 percent in June 2024. Foreign exchange reserves were high, amounting to USD 5,413.6 million at the end of September 2024 from USD 5,345.5 in June 2024. The reserves were more than 4 months of projected imports, which aligned with the country’s requirement.

Foreign exchange inflows are expected to improve further, attributable to high gold prices in the world market, increase in tourism, and exports of crops such as cashew nut, tobacco, coffee and cotton. Export of food crops to neighbouring countries, largely maize and rice, is also expected to increase foreign exchange inflows. On the demand side, moderate importation of fertilizers and lower prices of petroleum products are expected to lessen pressure on foreign exchange. The legal requirement of quoting and making domestic payments in Tanzanian shilling is also expected to ease pressure on foreign exchange and enhance the effectiveness of monetary policy. Furthermore, the Bank is expecting to continue accumulating reserves through the domestic gold purchase program using the Tanzania Shilling.

EMMANUEL M. TUTUBA

GOVERNOR